Real estate brokers are seeing an exodus of active agents in their markets—though whether this is a response to recent policy changes or just a seasonal fluctuation is currently unclear.

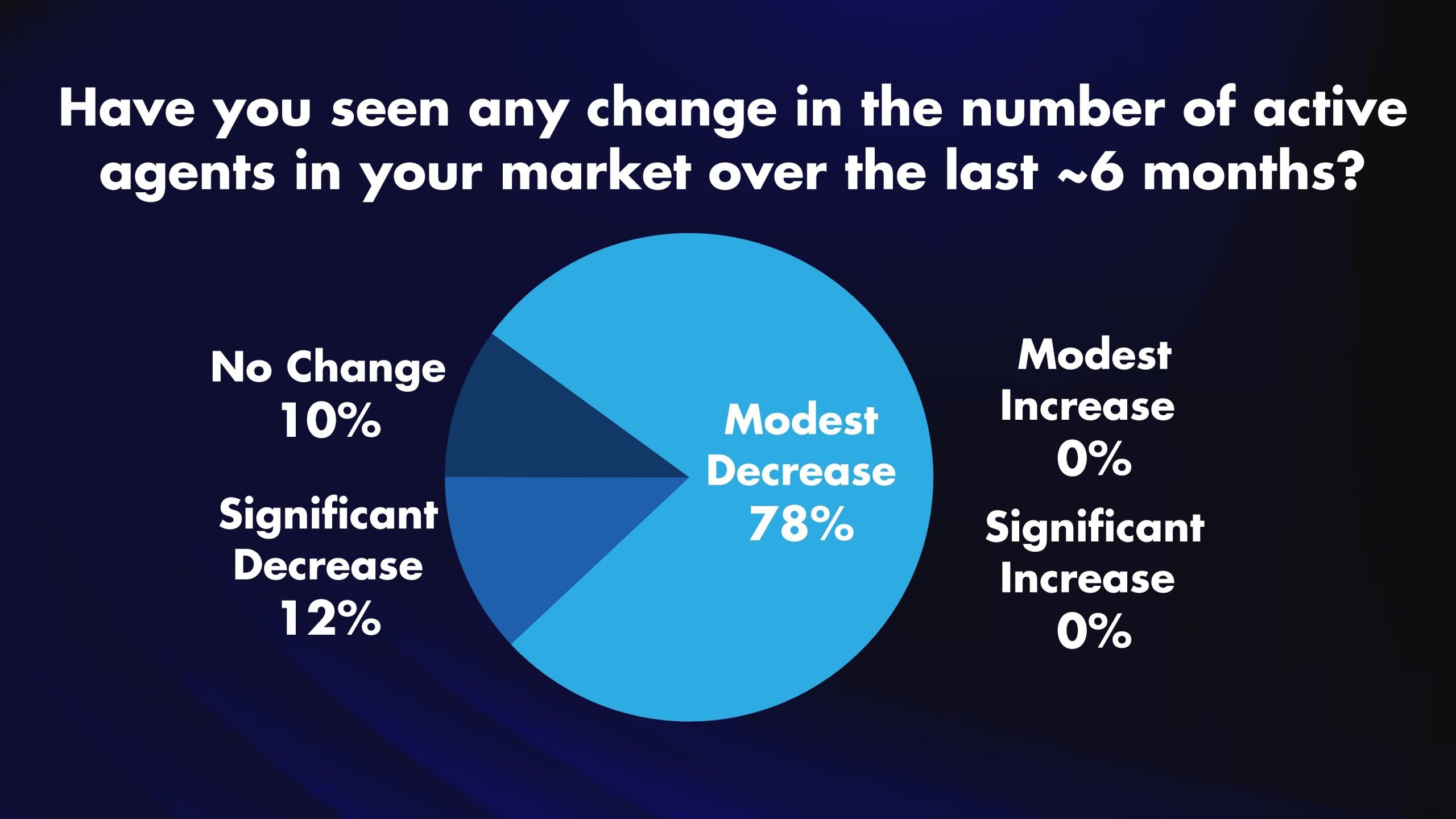

According to RISMedia’s latest Broker Confidence Index (BCI) survey, a huge majority of brokers—90%—observed a decrease in the number of agents who are actually present and practicing in their markets, with many more seeing a chance for further declines next year. The results come as speculation continues regarding whether the recently approved National Association of REALTORS®’ (NAR) settlement will shrink the overall agent count in the United States based on commission pressure or increased oversight.

“The uncertainty around the NAR settlement forced the number of agents to drop somewhat in my market,” said Darren Kittleson, principal broker for multiple Keller Williams’ franchises in Wisconsin.

“The uncertainty around the NAR settlement forced the number of agents to drop somewhat in my market,” said Darren Kittleson, principal broker for multiple Keller Williams’ franchises in Wisconsin.

While qualitatively, brokers were split on whether or not it was NAR policy changes driving the change or how significant it would be, the general consensus was that other factors are likely to push agents out of the industry over the next six months or so.

A little over two-thirds (67%) of respondents said that lawsuits—current or future—would decrease the number of active agents practicing in their markets, while 55% said they expected brokerages moving in or out of their region to have a negative effect on agent counts.

“Seasoned, older agents are not willing to navigate the new policy changes and (are) choosing to retire early,” said one broker, who requested anonymity. “Agents who entered the industry in the last four years are not making what they made during the propped-up Covid market.”

Counterintuitively, though the overall BCI reading rose slightly, from 6.2 to 6.4, bucking previous trends even though the index is far below near-term highs. That would seem to support a theory put forward by a good portion of respondents, who focused on other external factors apart from policy changes or seasonality as having a larger effect on agents’ decisions to join or leave the industry.

“Grass is greener; fairly new agents do not do what it takes to be successful, therefore, they are not successful,” said another broker who requested anonymity.

“Most (agents) feel that they will be able to cope with the settlement changes, and most feel that lower interest rates are on the way. Not many agents will leave the business,” said Scott Myers, broker/owner of CENTURY 21 Scott Myers REALTORS® in Texas.

In fact, brokers were almost entirely bullish on the economy, with 69% saying they actually believed at least some agents would join the industry in the next six months based on economic factors. But that was clearly not as large a factor as the other real estate-specific obstacles ahead, based on the overall sentiment.

Brokers were mixed on whether demand and inventory would improve enough to support an increase in active agents in their markets. A little less than half (44%) said they expected inventory changes to increase the number of active agents, while 34% said inventory issues will cause agents to leave. The remaining 22% did not see inventory having an effect on agent count in the near future.

The split was almost identical when looking at buyer demand—45% said they saw demand precipitating agent growth in their regions, while 33% said changes in demand would cause a decrease in agents.

With less than a month before 2025, only time will tell whether fluctuations in agent counts are permanent or transitory. NAR has largely reported membership remaining steady this year—though that doesn’t necessarily speak to “active” agents.

In previous surveys, brokers have voiced support for measures to make licensure more difficult, while RISMedia’s recent study of commissions found that inexperienced agents struggled more in the early post-settlement period compared to experienced agents.

“(Agents) just cannot afford to survive, which has always been a problem,” said yet another broker requesting anonymity, “but when you add inflation, high interest rates and less sales, they have no choice but to leave. The new rules were just the final straw for some agents, but that has not been the big factor, from what we see.”